owner draw quickbooks s-corp

An owners draw also called a draw is when a business owner takes funds out of their business for personal use. Owner Draw Quickbooks S-Corp.

C Corp Vs S Corp Partnership Proprietorship And Llc Toptal

Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria.

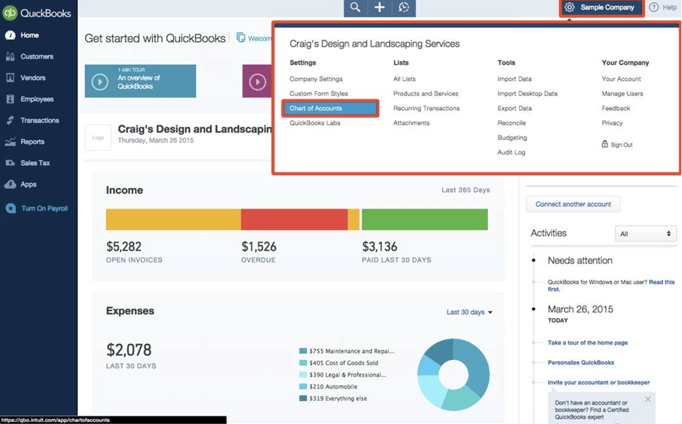

. An owners draw account is a type of equity account in which QuickBooks Desktop tracks withdrawals of assets from the company to pay an owner. New Jersey United States. Navigate to Accounting Menu to get to the chart of accounts page.

Owners draws can be scheduled at regular intervals or taken only. Setting Up an Owners Draw. Is a supplier of deep draw complex shapes sharp corners deep drawing deep drawn with top-quality materials.

Since an s corp is structured. Owners draws are usually taken from your owners equity. At the upper side of the page you need to.

But I cant find. Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. Sourcing product development compliance and logistics.

I worked as a consultant for several years in NY. You may find it on the left side of the page. Visit the Lists option from the main menu.

I lost my - Answered by a verified Employment. Owners draws can be scheduled at regular intervals or taken only when needed. Before you can record an owners draw youll first need to set one up in your Quickbooks account.

National Manufacturing Company Inc. An owners draw also known as a draw is when the business owner takes money out of the business for personal use. Up to 15 cash back Im the owner and only emlopyee of S-corporation in NJ.

Is a leading export management company focused on providing excellent service through our collective expertise in. Business owners might use a draw for compensation versus paying themselves a salary. Here are some steps.

Setting Up an Owners Draw Before you can record an owners draw youll first need to set one. The business owner takes.

Solved Enhanced Payroll Sole Proprietor Converted To Llc

How To Record Owner S Equity Draws In Quickbooks Online Youtube

Apply S Corp Medical At Year End For Corporate Officers Insightfulaccountant Com

Pay Yourself Right Owner S Draw Vs Salary Onpay

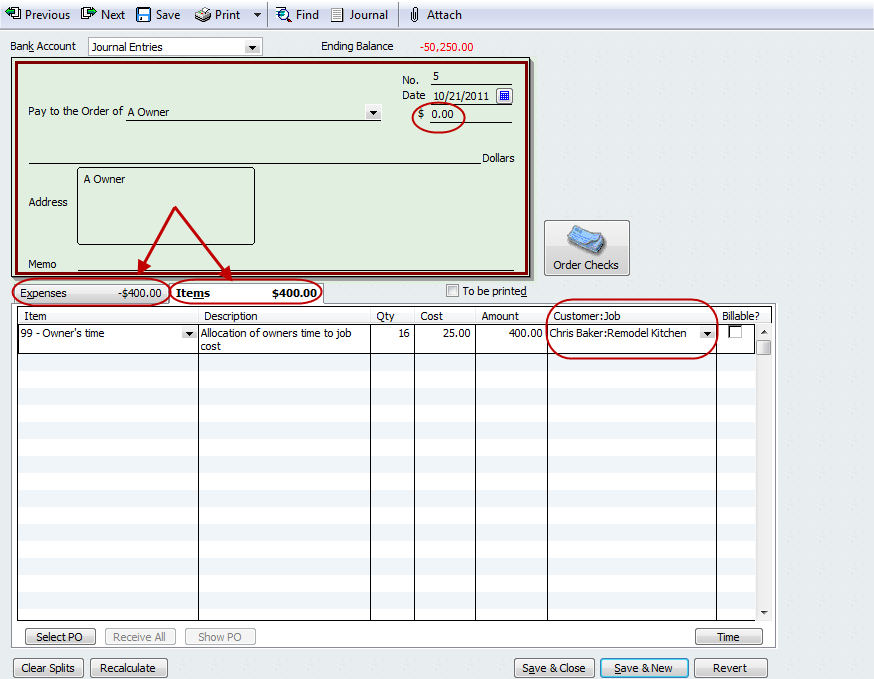

Quickbooks Tip Applying Owner S Time For Job Costing Long For Success Llc

How To Pay Yourself As A Business Owner In 2022 Tips For All Businesses

Setup And Pay Owner S Draw In Quickbooks Online Desktop

Understand How Small Business Owners Pay Themselves Track Self Employment Tax Liabilities Lend A Hand Accounting Llc

All About The Owners Draw And Distributions Let S Ledger

Solved S Corp Officer Compensation How To Enter Owner Equity And Balance The Books Properly After Member Draws Are Taken

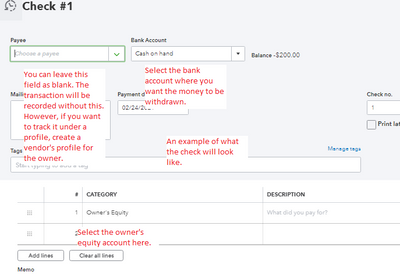

Set Up And Pay An Owner S Draw

Solved S Corp Officer Compensation How To Enter Owner Equity And Balance The Books Properly After Member Draws Are Taken

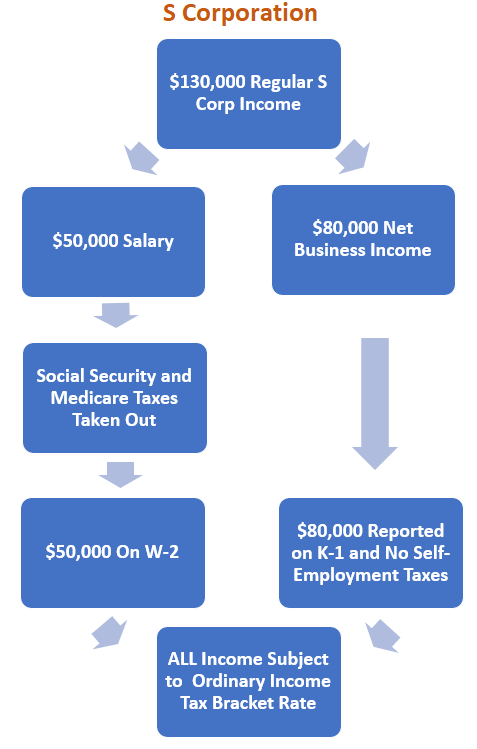

Taxation In An S Corporation Distributions Vs Owner S Compensation Youtube

How To Complete Form 1120s Schedule K 1 With Sample

Solved S Corp Officer Compensation How To Enter Owner Equity And Balance The Books Properly After Member Draws Are Taken

What Is An S Corp Reasonable Salary How To Pay Yourself The Right Way Collective Hub

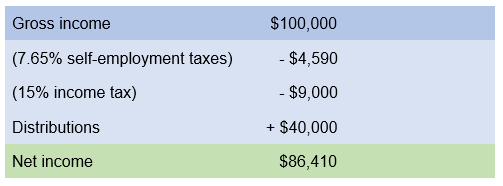

Benefits Of Owning An S Corp Taking Distributions